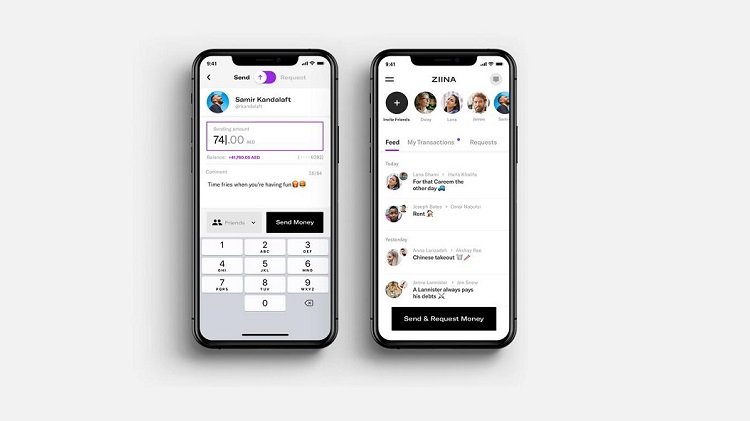

UAE bank account holders can now use their smartphones to send and receive money as easily as sending a text message. Ziina, the UAE’s first licensed social peer-to-peer (P2P) payment application, is available on the Apple App Store and Google Play Store for download.

Ziina is on a mission to simplify payments for everyone. Users can send and receive money with just a phone number — no IBAN or swift code required. Ziina offers bank-grade security and end-to-end encryption, never holding onto your money so every transfer goes fast. The app provides a seamless way for friends and family to split the cost of takeout or a grocery bill.

The young start-up raised a pre-seed round of US$850,000, led by San Francisco based Class 5 Global with participation from Samih Toukan’s Jabbar Internet Group, and other prominent angel investors.

Ziina’s cofounders – Faisal Toukan, CEO, Sarah Toukan, Chief Product Officer, and Andrew Gold, VP Engineering – look to encourage the adoption of mobile payment solutions in their bid to fast track the UAE’s transition towards a cashless society. They are joined by a strong advisory board including serial entrepreneur Samih Toukan, and Emre Tok, who previously served as VP of Growth at Careem leading a team of 80 people. The founding team recently launched the start-up’s operations out of Dubai’s In5 tech start-up incubator, with a license issued by TECOM.